How to do Automatic Bank Reconciliation in mygate?

Automatic bank reconciliation takes care of the major part of the reconciliation work with the least amount of manual effort. It has the following benefits.

1. Save hours of effort in doing bank reconciliation manually

2. Find flat numbers against each deposit in the society bank statement

3. Layman-friendly workflow

Transactions types that support auto reconciliation

Receipts: Online, EFT, Cheque

Payments: Vendor Cheque payments

Steps to follow for Auto Reconciliation:

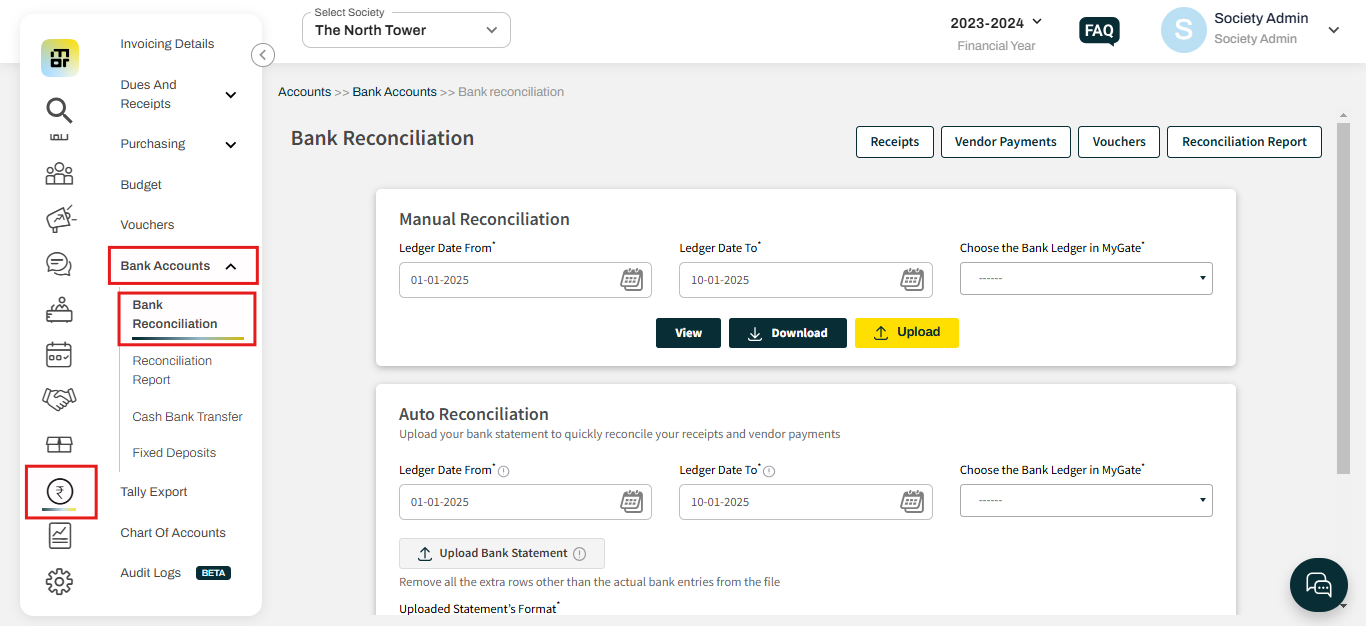

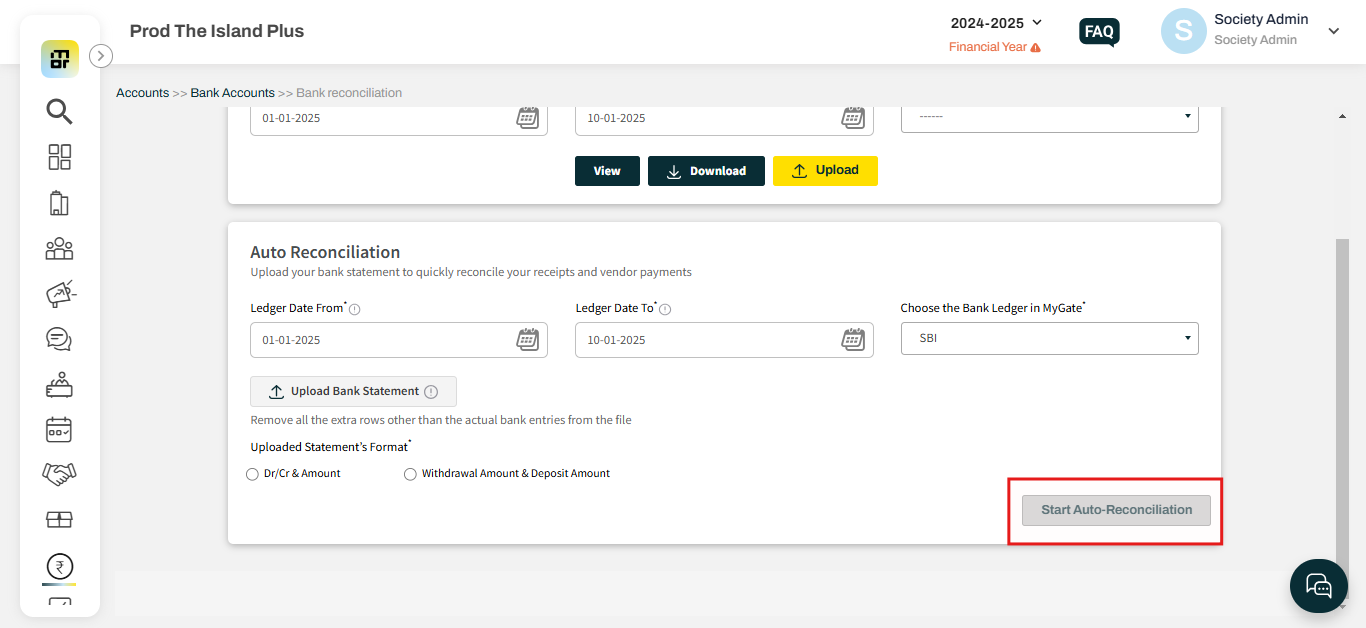

1. Go to the Bank Reconciliation option under the Bank Account section in the Account Tab.

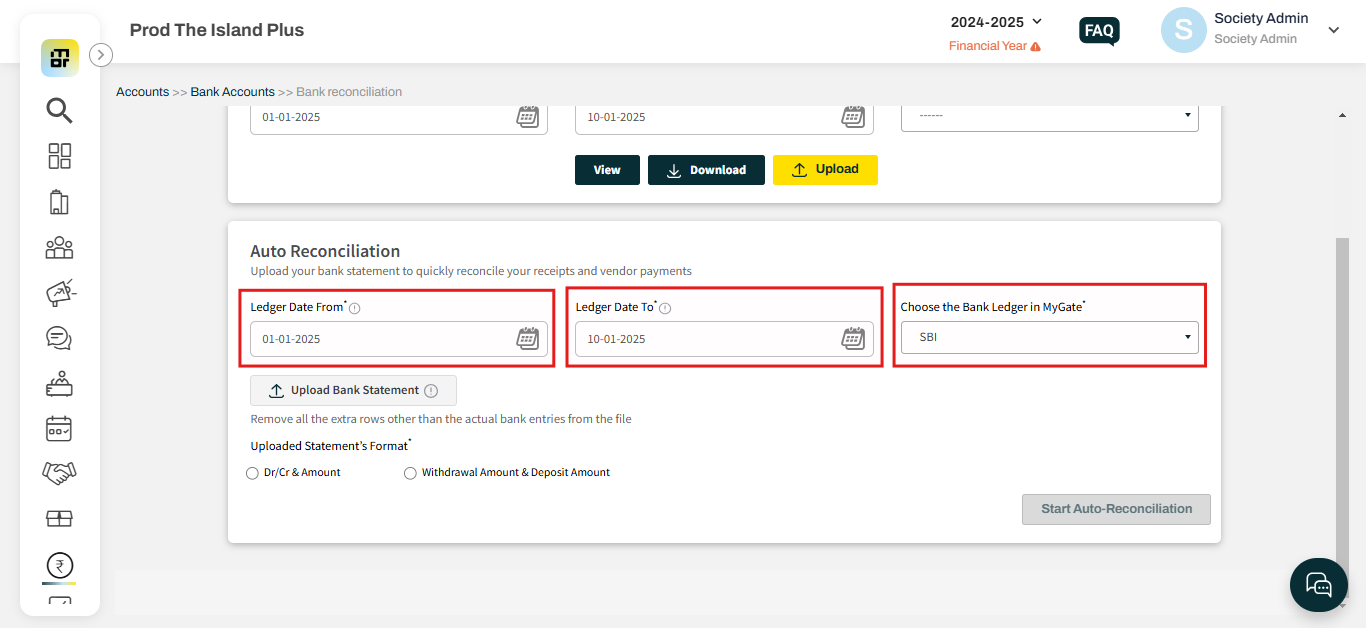

2. Select the From and To date(Max 1 month allowed) and then select the bank ledger name.

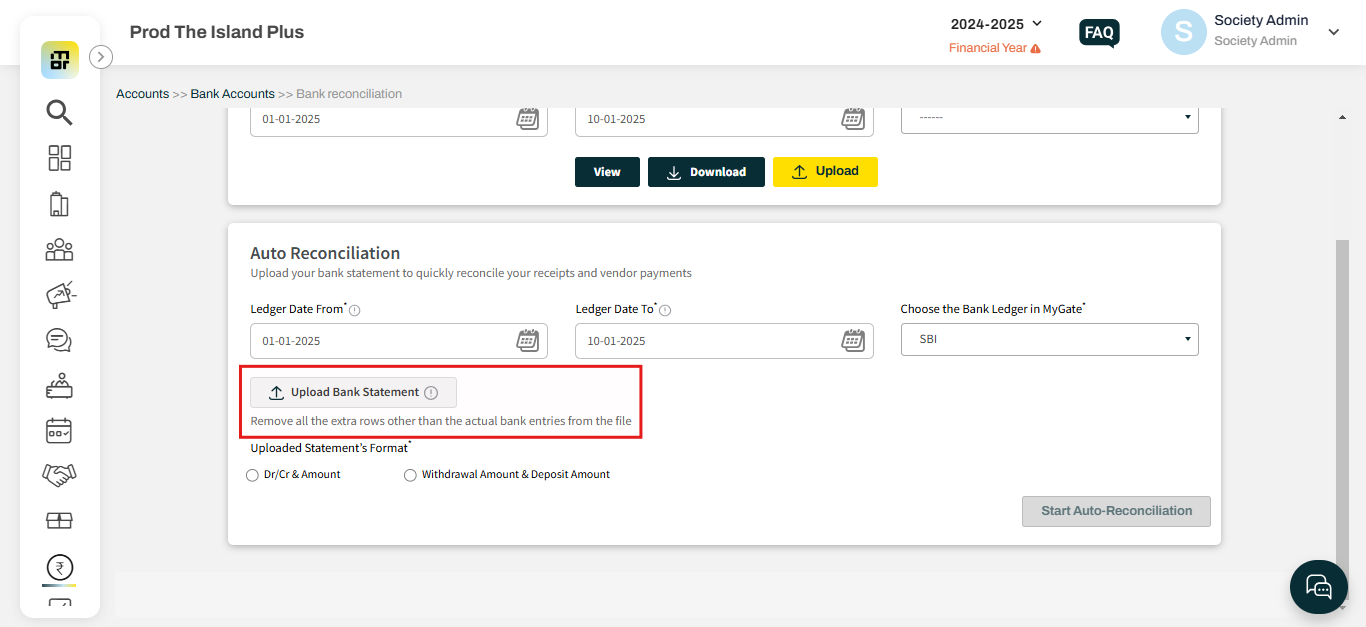

3. Upload the bank statement (Remove headers from the file and keep only transactions before upload)

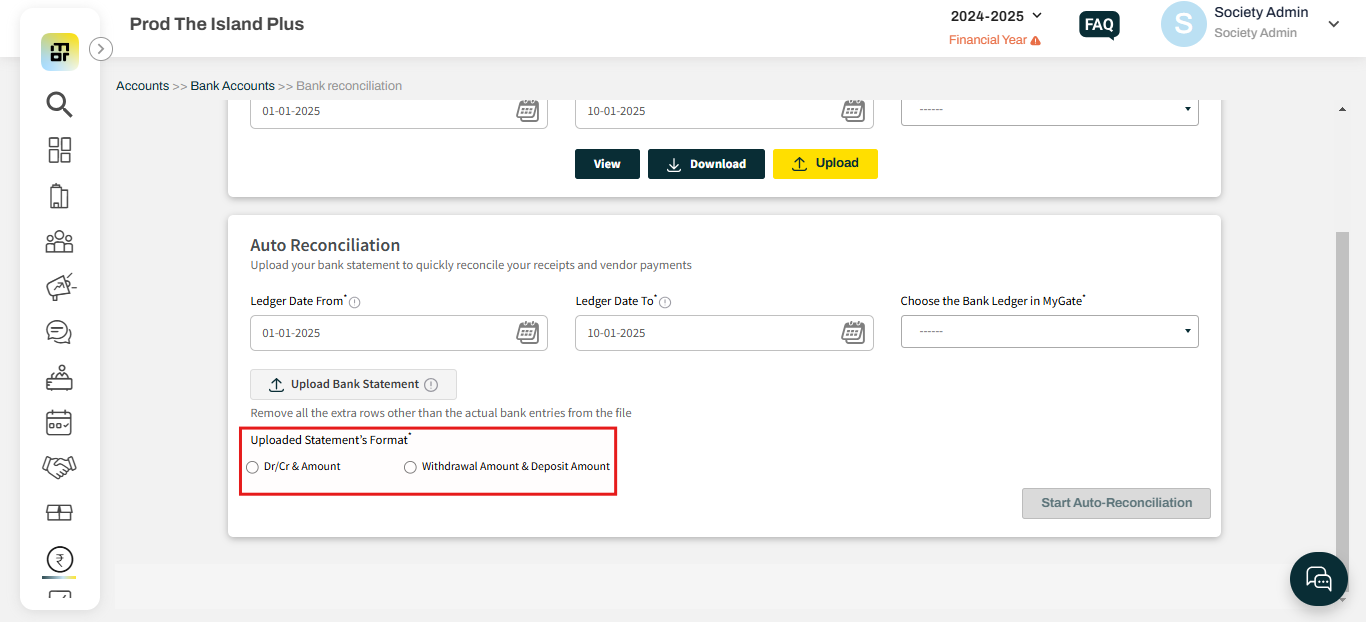

4. In the upload statement format, select whether the statement is in Dr/Cr or Withdrawal/deposit format

a. Select which column in the file has Dr/Cr (If Dr/Cr is selected in step 4)

b. Select which column in the file has the amount (If Dr/Cr is selected in step 4)

c. Select which column in the file has withdrawal amount details (If withdrawal/deposit is selected in step 4)

d. Select which column in the file has deposit amount details (If withdrawal/deposit is selected in step 4)

e. Select which column in the file has the date (For both Dr/Cr and withdrawal/deposit)

5. Select start auto reconciliation.

Dr/Cr format

Dr/Cr format is where a bank statement shows whether the transaction is a debit or credit in one column and debit and credit amounts in another column.

Sample:

Withdrawal/Deposit format

Withdrawal/Deposit format is where the bank statement shows withdrawal amounts in one column separately and deposit amounts in another column separately

Sample: