How to activate the E-invoice system?

Given the fact that B2B invoices should preferably be declared to the GST authorities on a real-time basis, you must ensure that all details surrounding the parties and invoice items are correctly updated on the dashboard. Here MyGate dashboard is functioning as the Application Services Provider (ASP) to build a direct link between your society and the GST Suvidha Portal.

Step 1: API User Registration

For the MyGate dashboard to be used for E-Invoicing, the society (seller) must register themselves onto their GST portal as API users. This registration provides an API ID and password against the seller’s GST number that should be shared with MyGate to allow linkage with the GST portal.

The steps to do the above are elaborated in the following document

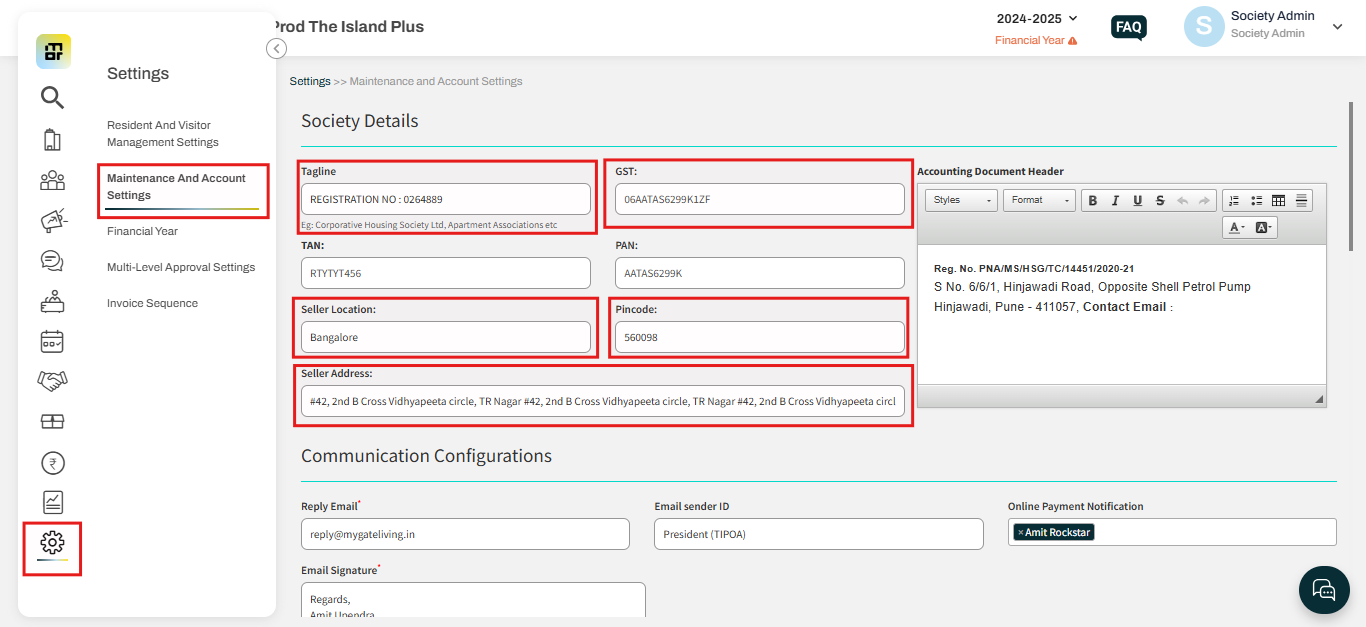

Step 2 : Mandatory Seller Details

The following details are mandatory from the society -

- Society GSTIN

- Society Registered Name

- Society Address

- Society Pincode

- Society Location (city associated with the above pincode)

The update must be made by the admin within the Maintenance and Accounts Settings under the settings tab for your admin dashboard.

Go to the Accounts tab then click on Maintenance and Account Settings.

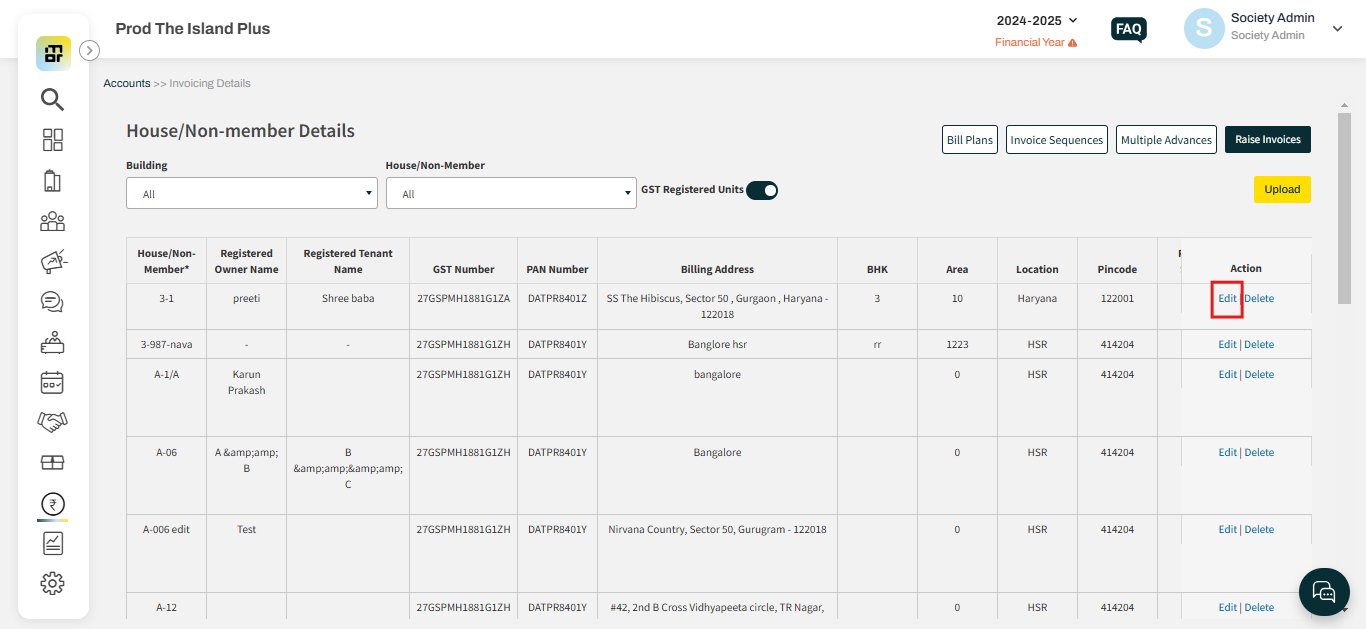

Step 3: Mandatory Buyer Details

The following details are mandatory for all the B2B houses and other debtors that are GST registered -

- Debtor GSTIN

- Debtor Registered Owner Name

- Debtor Billing Address

- Debtor Pincode

- Debtor Location (city associated with the above pincode)

- Debtor Place of Supply for goods or services (to decide between CGST/IGST billing)

The above details should be updated by the admin within the Billing Details

Go to the Accounts tab then click on Invoicing Details.

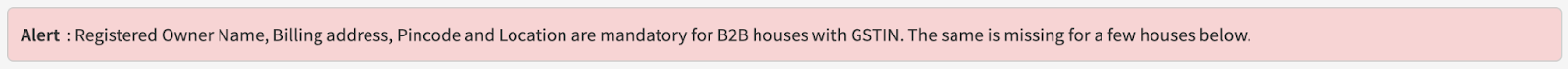

To ensure data sanctity for all B2B buyers, we show the following alert message if a GST number is entered for one and any other detail is missing.

Step 4 : Mandatory Invoicing and Penalty Details

While the rates and quantities for the invoice items along with their GST rates and values are handled by the invoicing system directly - it is mandatory to provide the HSN/SAC codes. The latter should also be updated to the individual penalty settings associated with the billing templates.

Step 5 : Activation of E-Invoice system

The API User Id and password from step 1 are essential for activation. Entering these credentials into MyGate’s invoicing system is deemed as an explicit consent to the ERP software to be able to raise E-Invoices for the seller.

We perform a test authentication call to the GST portal to verify the credentials before turning on the switch for E-Invoicing. (Society must either be on provisional penalty system or subsequent invoice penalty system)